Our beliefs

Warning

Based on its longstanding experience in the forest and vineyard markets in France and Europe, France Valley has built up strong convictions regarding the development of these assets. They do not constitute performance targets, these outlooks are based on assumptions that may not materialize, and unexpected events may still disrupt these underlying trends.

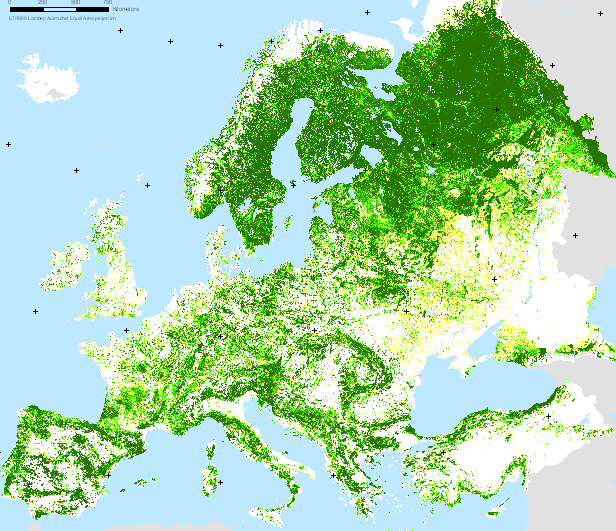

Source : Cartograf.fr

Timber and forests

Natural Assets, particularly forestry, are an increasingly sought-after investment for institutional investors. This asset class offers numerous advantages in terms of performance, sustainability and social impact. France Valley, a leading player in forestry investment in Europe, supports top-tier institutional players in their investment allocation.

Europe has an average afforestation rate of around 40% (with variations between 10% and 60%, covering 178 million hectares in the European Union) and a long tradition of forest management.

Main characteristics of the asset class :

Portfolio diversification through increased exposure to real assets and low correlation with other asset classes

Inflation hedging

Particularly attractive risk-adjusted performance

Positive contribution to investors' climate and biodiversity objectives, providing an immediate response to their responsible investment needs

The positive trend in this asset class is driven by underlying trends

Strongly rising demand for wood

Driven in particular by population growth and the increasing development of its use cases, wood demand is on the rise:

- Construction: the rate of use of timber frames in new homes in Europe is between 12% and 15%. It varies widely from country to country, and is growing steadily.

- Energy: wood accounts for 14% of energy production in Europe (source: Eurostat / IEA), being the main heating resource, surpassing wind power and photovoltaics. Burning pellets generates just 30 to 50 grams of CO2 per kWh, compared with 300 to 350 grams for fuel oil. What's more, sustainably managed forests offset these emissions. Public policy therefore supports the use of wood, strengthening Europe's energy independence.

- Substitution: anything made from oil can also be made from wood: textiles, plastics, packaging, screens and so on. Although not all solutions have yet been industrialized, this biodegradable and renewable material is set to gradually replace petroleum derivatives in everyday consumer products.

- Environmental services: forests are home to 70% of the world's biodiversity, regulate the water cycle through evapotranspiration from leaves and the root network, and capture 25-30% of CO2 emissions linked to human activity worldwide, according to a report by the Food and Agriculture Organization (FAO). These factors make them an increasingly strategic asset for the years to come.

Wood supply under pressure

While demand for wood is growing, its supply is facing constraints and insufficient supply. We can't build factories to manufacture wood, only forests can. A fortiori, according to United Nations figures, the world's forests are shrinking by 4.7 million hectares a year. Natural forests, which are not threatened by deforestation (particularly in France and Europe), are increasingly being protected to conserve biodiversity and mitigate climate change.

A growing need for climate and biodiversity solutions

As an asset class, natural capital such as forests has the lowest average carbon intensity of all alternative and traditional asset classes (measured by net CO2 emissions per euro invested).

Forestry investment today offers the greatest potential for generating significant environmental and climate benefits at scale. Trees can not only remove CO2 from the atmosphere, but also store it over the long term.

These characteristics are attracting the interest of institutional investors, as they become increasingly aware of climate risks and adopt positive contribution strategies in their investment portfolios. The prospect of carbon credits, a new source of revenue linked to the ecosystem services provided by forests, is further increasing investor interest.

In January 2023, the Net-Zero Asset Owner Alliance, representing over $6.5 trillion in Assets under Management, committed to a transition to carbon-neutral investment portfolios by 2050, according to the organization's latest report.

"Forestry funds are the Emerging Star of Alternative Investments. This 'Green Goldmine' is proving to be a promising avenue for long-term capital growth".

EY, Forestry Funds: The Emerging Star of Alternative Investments (2023)

Thus, although this cannot be guaranteed, France Valley anticipates a continued rise in wood prices in the face of growing demand and limited production. The value of forests, mainly determined by the stock of wood, should therefore appreciate, reinforcing their essential role for our future.

Investing in Europe with France Valley

France Valley, with over 10 years' experience, has a dynamic management approach in all the countries in which it operates. This extensive geographical coverage, in France and elsewhere in Europe, enables significant diversification and better risk mitigation:

- Optimized diversification: in terms of species, maturity, soils, climates and destination markets - enabling us to smooth performance and mitigate market risks.

- A robust, transparent legal framework: secured investment conditions in France and Europe, with clear protection of investors' rights allowing for utmost trust.

- An optimal level of control : in-depth markets knowledge, end-to-end control over forest management in conjunction with our network of partners, and geographical proximity to assets with frequent team visits.

- Mitigation of climate risks: fewer extreme weather events than in the United States and Latin America, and more consistent and diversified climate conditions in France Valley's selected countries, reducing the risk of forest fires and other natural disasters.

- Streamlined acquisition process: high agility and velocity in pan-european acquisition process, leveraging best practices across all our countries of operation.

Conclusion

Forestry investment in France and Europe offers institutional investors a unique opportunity to combine financial performance, diversification and environmental impact. With diversified revenue streams, steadily rising land prices and prospects for long-term capital gains, forests represent a strategic asset for those seeking to align profitability with sustainable commitment. As demand for wood continues to grow, forestry investment is becoming a cornerstone of institutional investments.

Warning

These are underlying trends, which are subject to change. Wood prices are increasingly correlated with industrial activity and consumption in general, and are sensitive to economic cycles, making them a good hedge against inflation. In addition, fiscal policies, notably in the energy and construction sectors, will also impact these trends, either upwards or downwards. Climatic and health risks are also factors of uncertainty: recurrent droughts weaken stands, and health crises can put large quantities of wood on the market, with a corresponding drop in price. But the underlying trends remain, so this investment should be considered over a period of at least ten years, and the longer the better.

Grapes and vines

Here again, it's the interplay of supply and demand for this raw material that influences investment performance, particularly in Champagne where France Valley has a strong presence. Global trends in Champagne consumption and exports have a direct impact on demand for grapes, affecting yields on sharecropping leases paid in kind and land values. The supply of grapes to wine merchants, who account for around 70% of shipments, is achieved in three ways: (i) by increasing the regulatory harvest volume per hectare, although this has its limits, especially in terms of preserving grape quality and complying with environmental standards; (ii) via supply contracts with harvesters and cooperatives; or (iii) by acquiring vineyards.

As far as China is concerned, growth in Champagne consumption could support the market in the long term.

Shipments there remain limited, with volumes comparable to those sent to the United Arab Emirates. By way of comparison, Japan, which had very limited Champagne consumption 25 years ago, is now the world's third-largest importer. Marketing initiatives by wine merchants could overcome cultural barriers similar to those in Japan, positioning Champagne as a powerful social marker.

Warning

This outlook is not certain, as events may postpone its realization (financial crisis, worsening relations with China, armed conflicts...), but the underlying trend also seems settled: in 2018, China accounted for around 1% of Champagne shipments, with some 1.9 million bottles shipped. At that time, total Champagne shipments worldwide were close to 300 million bottles. In 2023, total Champagne shipments will amount to 299 million bottles, with China accounting for around 2% of these shipments, or around 6 million bottles (Source: Comité Champagne). The impact of this increase in China has not yet been felt on land prices, due to the slowdown in consumption volumes in other countries, notably France and the UK.

Carbon Credits

At France Valley, we support investors in responsible portfolio diversification, with a strong focus on environmental impact. However, addressing expectations related to carbon offsetting requires a clear and educational approach.

Investing in an existing forest does not generate carbon credits, as it does not create additional CO₂ sequestration.

Carbon credits, whether derived from emission reductions or carbon removal, must be rigorously measured, certified, and monitored to ensure their integrity.

The fight against climate change is not limited to reducing emissions. It also requires the development of ecosystems capable of sustainably absorbing carbon. This involves ambitious projects like afforestation, which need significant private funding to complement public efforts.

We advocate for a strict framework for carbon credits to ensure they genuinely support the climate transition without replacing emission reduction efforts. While this mechanism is not without flaws, it is vital to achieving carbon neutrality goals set for 2050, and its growing demand reflects corporate commitment.

Beyond mitigating climate change, a key challenge lies in preserving and creating habitats for biodiversity. While carbon credits are essential today, tomorrow, “biodiversity credits” will be equally crucial for a sustainable future.

.png?width=300&height=302&name=Caroussel%20Livre%20Carbone%20(2).png)

Discover Our Carbon White Paper

Download our White Paper to gain a better understanding of forest carbon credits.

A dedicated team

at your service

![]()

![]()

![]()