Our investment solutions

in Natural Assets

France Valley is a leading European investment organization focused on Natural Capital, overseeing more €1,2 billion in Natural Assets as of December 01, 2025. Our portfolio spans 600 forests across 11 countries, encompassing a total of 64,000 hectares. We provide a diverse array of investment solutions tailored to meet the needs of all institutional investors.

Our Open-Ended Funds

French Timber Fund:

GFI France Valley Patrimoine

Largest French Timber Fund, invested in French Forests:

Capitalization:

652 M€

201 forests across

30 000+ hectares

- 49 French departments

- Greenfin-labeled funds¹

- Diversify your asset allocation with French forests

European Timber Fund:

SAS France Valley Foncière Europe

European Timber Fund invested across 11 countries providing high-quality diversification:

Capitalization:

171 M€

136 forests on

12 000+ hectares

- 8 European countries

- Greenfin-labeled funds¹

- Diversify your asset allocation with European forests

¹Established by the Ministry of the Environment, the Greenfin Label certifies the sustainability quality of investment funds. It is designed for financial entities committed to the common good through transparent and sustainable practices. The Label is delivered by EY, Novethic and Afnor Certification.

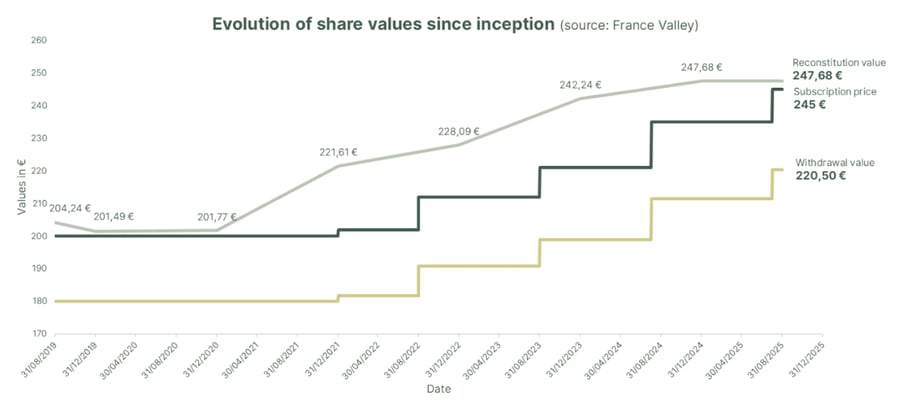

France Valley French Timber Fund Performance Track Record:

GFI France Valley Patrimoine

Since 2019, performance has been as follows:

Past performance is no guarantee of future results.

Our other funds

Funds Club

.jpg?width=1620&height=1080&name=USU%20SELECT%20(Pr%C3%A9sentation).jpg)

Reserved for institutional investors, currently in the process of raising funds on the carbon theme.

Service life

15 years

Target collection

200 M€

- Acquisition of bare lands in Europe for forestry purposes

- Target IRR over 10% (target not guaranteed)

Custom solutions

Tailor-made investment solutions reserved for institutional investors

Minimum

15 M€

Natural Assets

France and Europe

- A minimum of €15 million is required to achieve a certain level of diversification.

A dedicated team

at your service

Charles de Cointet

Executive Director

Eric Bengel

Executive Director